?

?If this particular broker had known exactly how far the bailouts reached, neither he nor his clients would ever have lost so much. But during the crisis it was decided, by people deemed more important than small-town investment advisers and their clients, that the full story of the bailouts didn?t need to be told.?

-Matt Taibbi

?

Most of the time, I am tickled pink at the brutal, no holds barred, Hunter S. Thompsonesque journalism of Matt Taibbi. (Full disclosure, I have been both a quoted and anonymous source for a long time). I tweeted and linked to his latest column, ?Secrets and Lies of the Bailout,? which brilliantly depicted the ongoing long con of the bailouts.

But I have to lodge a formal disagreement with his latest Taibbiblog post about George Hartzman, a Wachovia/Wells Fargo broker who was ?quietly killing it? in 2007-08, shorting financials as well as the market. He drank the Kool-Aid, and was short along with his clients. But like so many traders whose opositions are working, he got arrogant, overstayed his welcome, missed the bottom and reversal.

In other words, he and his clients got crushed.

It is a cautionary tale that raises many questions. The first I have to ask is this: What business did these mostly conservative clients (and their retirement accounts) have being short? That is a giant regulatory red flag, and a compliance problem. The second issue is the Broker/Dealer model ? this guy was a salesman (literally, a kick about, lots of sales jobs including aluminum swimming pools, vinyl siding and even encyclopedias before finding finance). He does not appear to be a true ?portfolio manager,? and certainly not a hedge fund manager. To my eye, he ? apparently ? lacked the skill set and discipline to be managing a large book of shorts positions. Indeed, he was less than an ideal candidate to be running such a risky and aggressive portfolio.

Most of all, he seems to have been a bad manager of risk.

There were lots of warning signs that the market?s enormous collapse was ending. Indeed, the biggest-since-1973 move to the downside was accompanied by all manner of signs that it had run its course. Every sentiment reading was pinned deep into the red: % of stocks below their 200 day moving average; new high/lows; insider buys/sells; market breadth; ARMS Index; downside volume; AAII Equity % of portfolios. From November 2008 to January 2009, Treasury yields dropped from 4% to 2%, then went negative in real terms. The VIX spiked to almost 90 late in 08; it was still over 50 in March 2009. Indeed, it was hard to find a rational reason to be short in March 2009 ? except naked fear.

Talk about the Recency effect! Anyone shorting equities in March 2009 after a 57%, 8,000 point Dow drop was looking backwards, not forwards. 57% down is not where you want to press your shorts, its where you cover and go long.

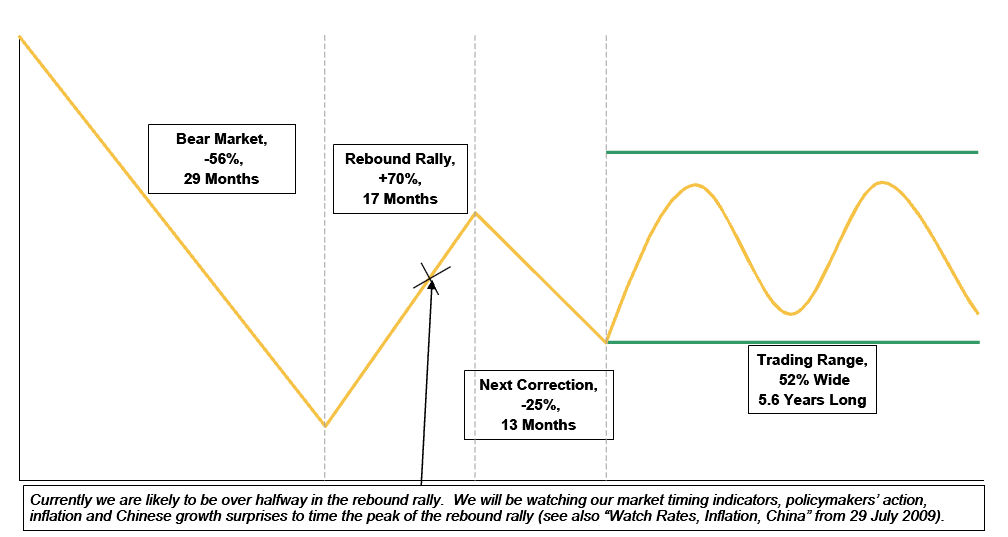

Any student of market history could have shown you dozens of studies as to when you take short trades off the table. The chart below is just one such example of a typical secular bear market (it is a composite of 19 such bear markets). I am the last person in the world to be defending the banks, the Fed, Hank Paulson, Alan Greenspan, Ben Bernanke, Tim Geithner, et al, but Damn! Even if you didn?t get long, you must at least at some point cover your shorts.

This is not Monday morning quarterbacking ? we were short Bear, Lehman and AIG (to my everlasting shame, I failed to ride the latter two down to zero). The massive capitulation in March 2009 was accompanied by indiscriminate panic selling. Bailouts or not, that?s when you cover shorts and buy, due to all of the aforementioned indicators ? and I said as much at the time.

Forget the secret info; the bailouts, which I deplored, where at the very least short term bullish. Hartzman and his clients lost all that money because he made aggressive trades and ignored the overwhelming public data about market internals and sentiment, and ran unsuitable trades without the skillset to manage them.

?

?

Typical Secular Bear Market and Its Aftermath

?

?

Source:

Secrets and Lies of the Bailout: One Broker?s Story

Matt Taibbi

Rolling Stone January 8, 2012??

http://www.rollingstone.com/politics/blogs/taibblog/secrets-and-lies-of-the-bailout-one-brokers-story-20130108

Source: http://www.ritholtz.com/blog/2013/01/bad-risk-management-not-secret-bailouts-killed-these-clients/

beverly hills hotel the watchmen whitney houston dies dolly parton i will always love you beverly hilton hotel whitney houston found dead i will always love you whitney houston

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.